The Impact of COVID-19 on Appraisal Market Analyses

Online Resources for Personal Property Valuations

Like many industries, we as qualified appraisers remain in Coronavirus limbo. While many of us stay abreast of the global economic influences on personal property valuations, we are not psychics. Although we can’t predict the future, we try our best to understand the marketplace based on current and past events.

Now more than ever, a contextual analysis in an appraisal report needs to be thorough. Equally important is a clear explanation of how the appraiser arrives at value conclusions, especially when an intended user is not familiar with a particular area of collecting, the art world in general, or the nuances of market levels.

The following information is intended to help you navigate this nebulous moment by suggesting several online resources that comment on the COVID-19 impact as it relates to personal property. For appraisers and the general public alike, this article can be a useful starting point to narrate, analyze, and cite the circumstances for items valued during these odd times.

Content will be updated when possible. Click on the green hyperlinks to access mentioned web pages. Don’t forget to double-check your references for accuracy. Last update: 8 November 2021.

Important Dates to Consider

It’s helpful to establish the sequence of events surrounding the COVID-19 pandemic as it pertains to the appraisal assignment. In addition to the typical dates included in the appraisal report – e.g., effective date of valuation, day(s) of inspection, delivery date of report, etc. – other timely details may also be incorporated. Below are additional options.

March 11, 2020

The World Health Organization declared the coronavirus a global pandemic, as the number of countries with cases of the viral disease reached 114. (Source: “WHO Director-General's opening remarks at the media briefing on COVID-19 - 11 March 2020,” World Health Organization website.)

Mandated Timeframe for Residents to Stay at Home

Depending on the state or region, various terms have been used to describe this self-quarantine directive such as “Shelter in Place,” “Safer at Home,” and “Stay Home, Stay Healthy.” Clarify which date and phrase have been used as is relevant to the appraised property.

One quote that I find illustrative for the United States comes during April 2020 from The New York Times: “…The number of Americans under instructions to stay at home had surged, accounting for 95 percent of the population.” (Source: “See Which States and Cities Have Told Residents to Stay at Home,” The New York Times. Scroll to the bottom of the article where you can choose by state.)

Resuming In-Person Business & Daily Life

As of the most recent update of this article on July 17, 2021, we are still in the midst of COVID-19 with daily life yet to completely resume “as usual.” However, hope is on the horizon in the United States with vaccinations taking place across the country. Most states have re-opened business with some maintaining certain restrictions. (See “Coronavirus Restrictions and Mask Mandates for All 50 States,” New York Times)

Not surprisingly, global issues have varying impacts on different categories of property. With our interconnected economies, waves of disruption in other countries will have ripple effects since seller supply and buyer demand may be concentrated elsewhere in places that are recovering at varying paces. For instance, a second wave of the Coronavirus has devastated India, where only a small percentage of the population has been able to receive vaccinations. (See “Coronavirus in India, What to Know,” The New York Times)

May 13, 2021

The Centers for Disease Control and Prevention (CDC) stated that people who are fully vaccinated against COVID-19 may forgo wearing face masks for most indoor and outdoor activities. Many states adjusted their own mask mandates to align with the federal guidelines while others have relaxed rules in most settings. (See “State by State Face Mask Mandates” to review local differences, Leading Age)

This official guidance resulted in many people returning to in-person activities by June of 2021. While updated guidance has been given for gatherings with fully vaccinated and unvaccinated, most industries have returned to pre-pandemic standards of work. However, many larger companies are allowing employees to continue working remotely until the end of 2021.

Pay Attention to Press Releases

Press releases are useful communication tools to announce newsworthy statements or events. Those from the private sector are often a form of promotion, but they can also be snapshots of the who, what, when, and where of specific market moments. Below are a variety of press release sources to review during the Coronavirus era.

The Appraisal Foundation (TAF)

The Appraisal Foundation is authorized by U.S. Congress as the source for appraisal standards and appraisal qualifications. They currently have a webpage dedicated to the impact of COIVD-19 on the appraiser profession for personal property as well as real and business properties. (Source: “Coronavirus and Appraisers: Your Questions Answered,” The Appraisal Foundation website.)

International and Regional Auction Houses

Many auction houses have been sending press releases to demonstrate that items continue to sell despite the unusual circumstances. As you can imagine, these venues have an inherent bias to give a positive spin. Nevertheless, their facts and figures (particularly sell-through rates) are useful data in a business that prefers to keep transactions opaque.

In fact, the regular reading of these newsletters is a good habit for appraisers at any time and most especially when significant economic change occurs. Sign up to receive emails from auction houses relevant to your subject field and geographic region.

PRESS RELEASE EXAMPLES:

Freeman’s April 3rd sale: “Freeman’s Online Only Design Sale Soars Past Pre-Sale High Estimate, Achieves $1.2 Million”

Sotheby’s May 15th sale: “Sotheby’s First-Ever Online Day Sale of Contemporary Art Achieves Record-Setting $13.7 Million in New York”

Christie’s May 18th sale: “RESULTS: First Open Online Only Sale Totals: $1,668,625 | 100% by Value | 80% by Lot”

Forbes: “As Retail Tanked During The Coronavirus Pandemic, Auction Houses Cranked Out Impressive Sales”

Sotheby’s July 9th sale: “Sotheby's Hong Kong Fine Classical Chinese Paintings Sale Totals HK$76,362,500 / US$9,848,000”

Sotheby’s July 28th sale: “Record-Breaking Rembrandt to Richter Sale Reinvents the Auction”

Phillips’ September 24th sale: “Amoako Boafo, Titus Kaphar, Matthew Wong Lead Phillips $5.8 M. ‘New Now’ Sale”

Christie’s December 8th sale: “Christie’s New York Magnificent Jewels totals $44.58 million”

Heritage Auctions December 10-13th sale: “Heritage Auctions Breaks All-Time Sports Auction Record with $22 Million Event”

Freeman’s 2020 Review: “2020 Milestones | A Message from Alasdair Nichol”

Art Market Monitor, January 2021 predictions: “After Pandemic’s Rapid Change, Sotheby’s Has 8 Predictions for 2021”

Christie’s February 16, 2021 sale: “Christie’s to Offer the First Purely Digital NFT-Based Work of Art Ever Offered by a Major Auction House”

Sotheby’s: “2021 Art Market Trend and Predictions”

As a side note, it’s been a decade-long uptick for auction houses to promote online bidding. Most choose to sell online during COVID-19 to protect the health of staff and customers. Even before the Coronavirus, several companies had already started to dedicate part of their calendar to exclusively online sales. It will be interesting to see how this shift to digital previewing evolves after the crisis has waned. In fact, Amy Cappellazzo of Sotheby’s was recently quoted: “I’m thinking really seriously about what the online experience is for our clients. In effect, we’ve been in the live theater business. Now we’re segueing into what is more like live streaming. The truth is, that revolution has been underway for some time.” (Source: “Auction Houses Postpone Live Sales and Pivot to Online,” The New York Times.)

Subscription Price Databases

Similar to when reviewing auction house press releases, keep in mind that database companies are invested in profitable transactions so as to retain subscribers. Yet the amalgamation of sales results available to them is priceless for revealing trends. Below is a sampling:

Artsy: “Ongoing Coverage of COVID-19’s Impact on the Art World”

Mutual Art: “Experiencing Art in a Time of Social Distancing”

Artprice: “The art market reacts to Covid-19”

Live Auctioneers: “Auction Central News”

Artnet: “Art Intelligence Report” (scroll to the bottom of page for summary of ‘Key Findings - Fall 2020’)

Mutual Art: “Uncharted Territory in the Art Market”

Mutual Art: “2020’s Last Hurrah”

Artnet: “Price Check! Here’s What Sold—and for How Much—Through Art Basel Miami Beach’s Online Viewing Room”

Mutual Art: “The Three Key Moments This Year That Changed the Art Market”

Mutual Art: “Art Market Still Strong”

Artnet: “We Know the Art Market Is in Recovery. But How Do the Numbers Stack Up to Pre-Pandemic Times?”

Keep Tabs on Industry & Financial News

Many collecting areas have a publication dedicated to industry-specific coverage. And most have an online presence where they blog the occasional news post. In addition to at micro-look a niche trades, balance your research with a larger overview from financial institutions. To narrow your focus, think of possible search keywords like “wealth management” and “tangible assets.”

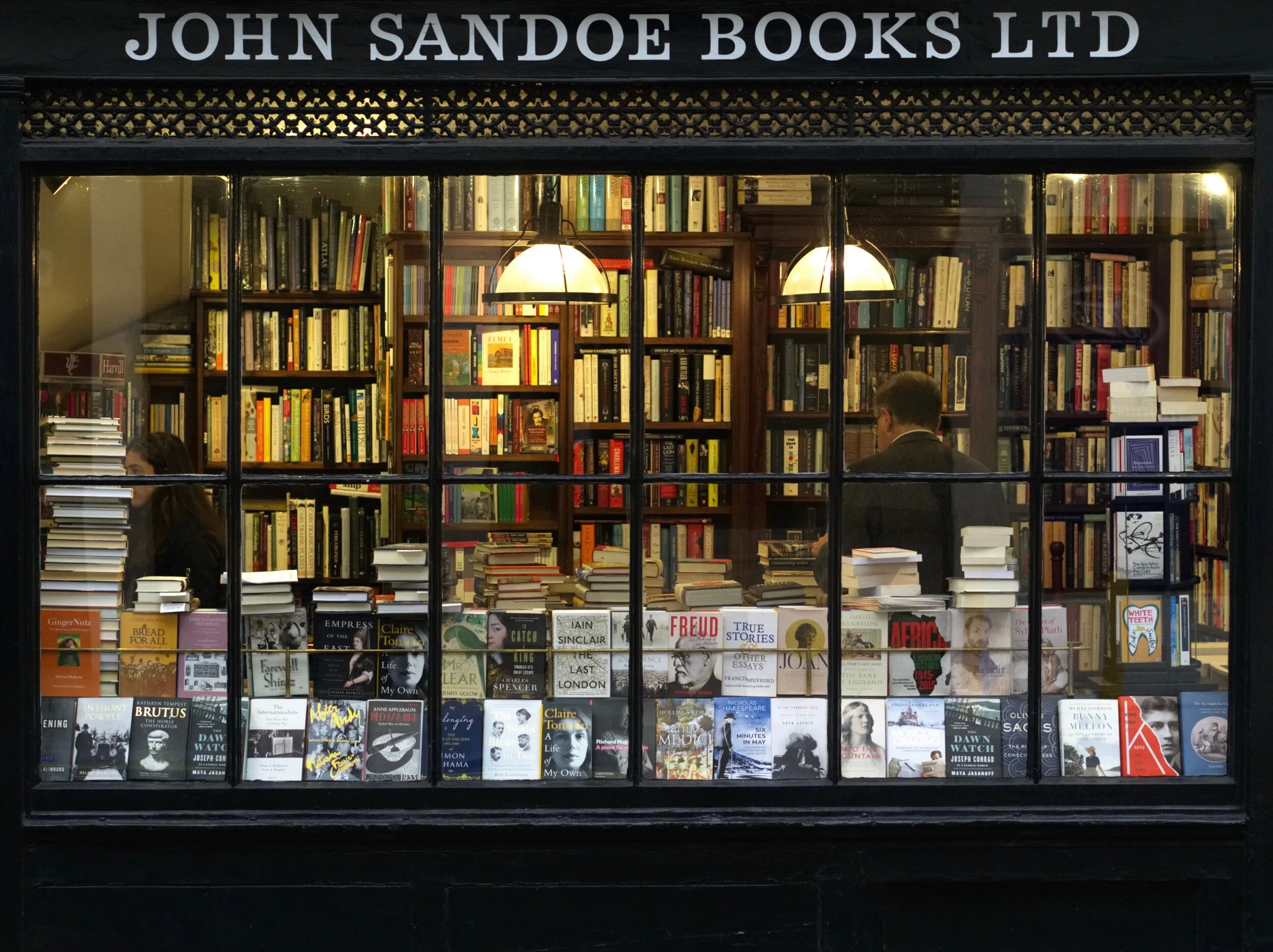

Below is an example of what could be the go-to sites for an appraiser who specializes in fine art and rare books. Select your own sources and check in every now and then to see if they’ve added additional commentary.

ART TRADE NEWS:

The Art Newspaper: “Great Depression of the 21st century looms over the art market”

Hyperallergic: “A Daily Report on How COVID-19 Is Impacting the Art World”

ARTnews: “Coronavirus Outbreak”

Art & Object: “How COVID-19 Has Affected the Global Art Market”

Art News: “In Substantial Shift, Museum Industry Group Pushes Directors to Break the Rules to Survive”

The Art Newspaper: “Post-pandemic, the art market might return to 'normal'—but do we want it to?”

ARTnews: “Collectors’ Toolkit: How Does the Coronavirus Affect Artworks’ Insurance Value?”

Doug Woodham: “What the COVID-19 Crisis Means for Collectors”

ADAA: “U.S. Art Galleries Project 73% Loss in Second Quarter Revenue Due to COVID-19 Developments”

Antiques & The Arts Weekly: “Antiques Shops Begin Process Of Cautiously Reopening”

Art Basel & UBS: “Conversations: The impact of Covid-19 on the art market”

Bloomberg: “Art Galleries Survived the Lockdowns. Now Comes the Hard Part”

The Wall Street Journal: “Christie’s Tests the Art Market’s Strength Amid Coronavirus”

The Art Newspaper: “Could Covid-19 kill off the market for the art world’s star names?”

ARTnews: “Art Basel Cancels Bellwether Miami Beach Fair Following Pandemic Concerns”

Art | Basel: “The Art Basel and UBS Global Art Market Report” (review key findings)

UBS: “7 Insights from the Art Basel and UBS Global Art Market Report 2020” (download full survey)

Sotheby’s: “Volatility Can Be a Good Thing,” Says One Art Market Insider”

The Wall Street Journal: “Cézanne, Picasso and a T. Rex—This Auction Season, Anything Goes”

The New York Times: “Pandemic Has Cut Modern and Contemporary Gallery Sales 36%, Report Says”

Apollo Magazine: “Art market predictions for 2021”

Sotheby’s: “2021 Art Market Trends and Predictions”

ARTnews: “Christie’s CEO Guillaume Cerutti Faces a New Pandemic-Era Reality”

UBS: “5 Insights from the Art Basel and UBS Global Art Market Report 2021” (download the full report)

Reuters: “Analysis: One year into pandemic, the art world adapts to survive”

The Wall Street Journal: “Millennial Buyers Help Global Art Market Survive the Covid Pandemic”

The Art Newspaper: “The future’s bright: Millennials help art market stage post-pandemic recovery”

TEFAF: Art Patronage Report 2020

Art Basel and UBS: “Resilience in the Dealer Sector: A Mid-Year Review 2021 – Key Findings”

ANTIQUARIAN BOOK TRADE NEWS:

Rare Book Monthly: “Revising Appraisals due to the Coronavirus”

Fine Books & Collections: “How COVID-19 is Affecting Antiquarian Booksellers”

The New Antiquarian Blog: “ABAA Members Adjust to Self-Isolation”

The viaLibri Blog: “Zooming The Coronavirus & Book Trade Lockdown”

Rare Book Hub: “Rare Book Monthly Articles”; “Bookselling In A Time Of Coronavirus”

World Economic Forum: “The importance of books as we struggle with COVID-19”

Antiques & The Arts Weekly: “NYC’s Premier Antiquarian Book Fair Turns A Page: Event Marks 60th Year Milestone”

Wired: “The Coronavirus Pandemic Is Changing How People Buy Books”

The Antiquarian Booksellers’ Association of America: “ABAA Virtual Book Fair, June 4-7, 2020”

Bloomberg: “Contemporary Art Needs Big Gatherings and Gossip to Survive”

Art Business: “Art Market Trends in Response to COVID-19”

Rare Book Hub: “Are Live Book Fairs Done for the Year?”

Rare Book Hub: “Money Money Money”

Fine Books & Collections: “The Antiquarian Book Trade Innovates in the Wake of COVID-19”

Rare Book School: “Gains & Losses: COVID-19, Institutional Collecting, and the Antiquarian Book Trade” (watch YouTube recording)

Rare Book Hub: “AbeBooks Top 10 Most Expensive Sales for the Third Quarter of 2020”

Bloomberg: “Retail Might Be Struggling, But the Rich Are Buying Rare Books”

ILAB: “Wrapping up 2020 - We did it! But how?” (December 7th Webinar)

Rare Book Hub: “The Year the War, the Year that Will Be” Parts I, II & III

Fine Books & Collections: “Antiquarian Booksellers Reflect on 2020 and Plan for 2021”

Rare Book Hub: “Where are we? - July 2021”

Rare Book Monthly: “The Final Stretch for 2021: Projections & Implications”

Lit Hub: “The new COVID trend? Apparently, it’s buying rare books”

FINANCIAL NEWS:

Morgan Stanley: “What are Markets Thinking?”

Bloomberg: “Rich People Are Raising Cash From Their Art Collections”

Bloomberg: “Assessing liquidity for a new abnormal”

Business Insider: “Wealthy art owners are raising cash from their collections amid the looming recession”

Wealth Management: “The Impact of Covid-19 on the Art Market”

Financial Times: “Art market confidence is lower than the 2008 crisis, reports show”

Wall Street Journal: “A Bad Year for Art Is Looking Like a Good Year for Art-Backed Loans”

Financial Times: “Auction sales halve in 2020 in spite of online boost”

Bloomberg: “Contemporary Art Needs Big Gatherings and Gossip to Survive”

Bank of America: “Art Market Update - June 2020”

Independent art fair and Crozier Fine Arts: “The New York Art Market Report”

UBS: “The Impact of COVID-19 on the Gallery Sector: 7 Key Findings on Collecting”

Financial Times: “Art market: Predictions for 2021”

Financial Times: “Auction sales more than triple this year”

A Virtual Marketplace

With in-person transactions on hold, sellers pivoted and relied more heavily on web-based platforms. Art shows, antiques fairs, and galleries are all finding ways to keep their doors open by digital means. Similar to online sales for auction house, many dealers created virtual exhibitions and viewing rooms to promote buying. A prime example is Frieze, the prestigious modern and contemporary art fair. In 2020, their physical booths were transformed into virtual viewing rooms. Similarly, the European Fine Art Fairs (TEFAF) chose to move their New York November 2020 show to premiere exclusively online.

While access is was only a click away, was the user experience be engaging enough to inspire purchases? Only retrospection and honest disclosure of salethrough will tell. However, it’s likely that this sudden hyper-dependence on a virtual marketplace is a make-or-break moment for many in the trade.

Forbes: “COVID-19 Is Accelerating The Art World’s Adoption Of Technology”

Widewalls: “How Coronavirus Makes The Art World Go On(line)”

CoBo Social: “How Sustainable is the Art World Going Online during COVID-19?”

Artsy: “Will Online Viewing Rooms Increase Price Transparency at Galleries?”

Frieze Viewing Room: Open May 8-15, 2020

Antiques & The Arts Weekly: “First For Everything: May Brimfield Goes Digital, Unites Collecting Community & Makes Sales”

Financial Times: “Art Basel’s Marc Spiegler: ‘The future of the art world is not digital’ ”

The Art Newspaper: “Online marketplaces proliferate as the coronavirus pandemic continues”

Artsy: “Three Key Takeaways from the Hiscox Online Art Market Report” (download the report here.)

The New York Times: “Sotheby’s Reports $2.5 Billion in Sales”

The Art Newspaper: “How Covid-19 has forced the art market’s speedy digital conversion”

Art Market Monitor: “Hiscox 2020 Report Finds Online Sales Reach $4.8 B., Outpacing Overall Art Market Performance”

Artsy: “6 Market Experts’ Top Takeaways from This Summer’s Virtual Auctions”

TEFAF New York: Exclusively Online, Nov 1–4, 2020 with 280 Masterpieces

ARTnews: “When the Pandemic Forced the Art World Online, Some People Began Collecting—Or Returned to It”

The Wall Street Journal: “The Rich Rewards of Online Furniture Auctions, and How to Get Started”

Antiques Trade Gazette: “Covid-19 has “turbo-charged the online art market” latest report reveals”

Refer to Appraisal Societies & Organizations

All three major personal property appraisal organizations have come together to create a guide for their members. On their main websites, each society has included information and suggested language for developing reports until the markets are stabilized. See below for some direct links.

International Society of Appraisers (ISA): “Tips for Appraisal Reports During COVID-19” has a blog post; “The Uncertain Chinese Art Market” by Susan Lahey for ISA.

Appraisers Association of America (AAA): “Tips for Appraisal Reports During COVID-19” in pdf format; “Supportive Resources” with a variety of free material related to art law, appraising, and artists.

American Society of Appraisers (ASA): “Important COVID-19 Update”; scroll down to the ‘Personal Property’ subcategory to find hyperlinks to third-party media coverage.

Decide if You Want to Perform Desktop Appraisals

According to the Uniform Standards of Professional Appraisal Practice (USPAP), an appraiser isn’t required to physically inspect the property being valued. However, the appraiser must believe that the resulting valuation is credible based on sufficient information provided by the client. Such evidence may include inventory lists, images, a virtual walk-through, past appraisals, family records, etc. As with any assignment, the appraiser should narrate the scope of work in the final report and mention limiting conditions and extraordinary assumptions. Given the likelihood of ongoing volatility, you may offer the option to revisit the property in six-months’ time.

It’s at the appraiser’s discretion to decide if a desktop/remote appraisal will be part of their services. Check the most current USPAP edition to ensure the standards for a qualified appraisal are followed.

In Conclusion

In the best-case scenario, your appraisal is an opinion of value supported by property-based evidence, relevant facts, and reasonable conclusions. To provide such service becomes a more significant challenge when society is in flux, let alone due to an unprecedented pandemic. While the extent of Coronavirus ramifications remains unclear, we can be diligent in finding market references to strengthen analyses. My hope is that the appraisal industry continues fostering a community where we figure out the unfolding events of COVID-19 together.

The information in this article is for general informational purposes only and is not considered legal advice or a legal opinion. In addition, topics may not necessarily reflect the most current economic, legal, and appraisal developments. Verify sources independently and seek the advice of an appropriate professional if needed.

About the Author: Courtney Ahlstrom Christy is Co-Editor of Worthwhile Magazine and Principal Appraiser of Ahlstrom Appraisals LLC. Courtney can be reached at ahlstromappraisals.com.

© Courtney Ahlstrom Christy 2020